Entering Your US taxpayer Identification Number (TIN)

Why am I being asked to provide my TIN again?

We require your Taxpayer Identification Number (TIN) in order to process your Enhanced Digital Certification (EDC) application. You previously furnished your TIN but the information provided did not match the IRS records and has been removed from your SupplierGATEWAY profile.

There are a number of reasons why this may have happened, including:

- The name of the entity you have registered in the system is not the Legal Name for your organization

- You made an error when entering the TIN

- You have registered your company under your DBA and not the Legal Name for your company

- Your TIN is new and the IRS has not yet updated their systems

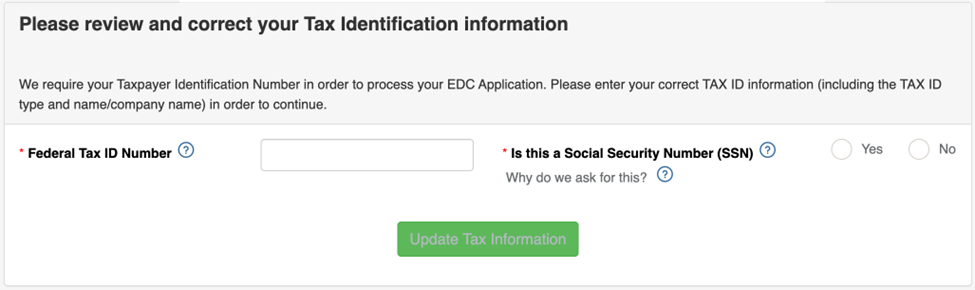

Where should I enter my TIN?

Please enter your correct 9-digit Taxpayer Identification Number (TIN) and select the response to the question about whether you are using your SSN, in order to continue. This information is required to match with the IRS database.

IMPORTANT: Please enter your information as it shows on your IRS correspondence such as the SS-4 confirmation letter or the LTR 143C provided by the IRS.

After you enter your TIN, you may be prompted to enter your Company name – remember to enter the Legal Name.

If the information is validated then you will proceed to the next step of the EDC application process which is the ID Verification.

Tips on how to confirm your Taxpayer ID and Legal Company Name

Here are some examples on where to find your Taxpayer AND legal Company name as the IRS has recorded them

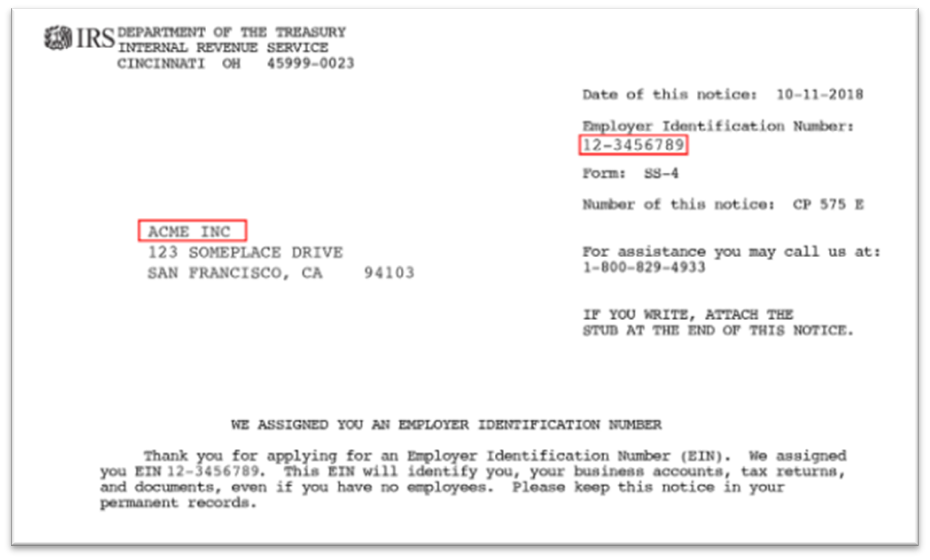

IRS SS-4 Confirmation Letter

What is a SS-4 confirmation letter?

The SS-4 confirmation letter from the IRS is a formal confirmation that you have been assigned a Employer Identification Number (EIN), also known as a Taxpayer Identification Number (TIN).

Below are two examples on how you can enter your information based off of the SS-4 confirmation letter.

EXAMPLE 1

If your business name looks like the above on your SS-4 confirmation letter, you might need to enter the following as your legal business name:

ACME LLC

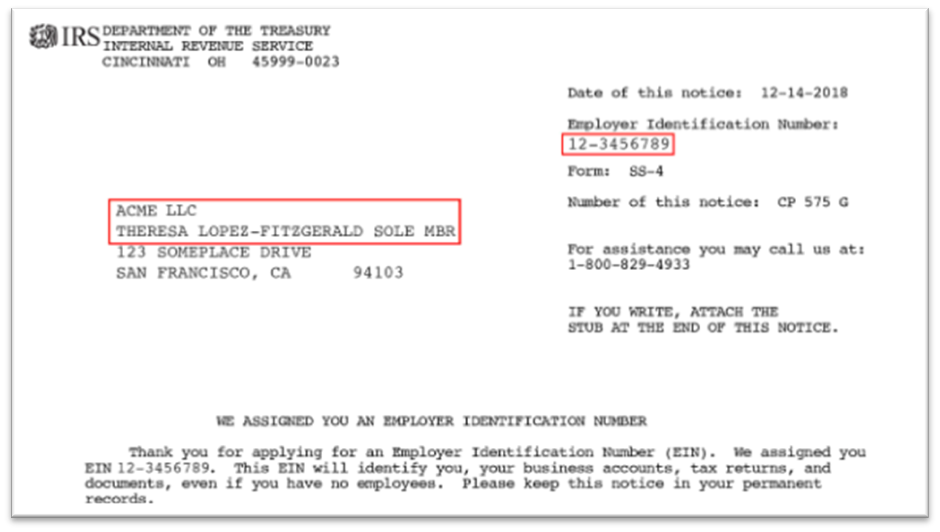

EXAMPLE 2

If your business name looks like the above on your SS-4 confirmation letter, you might need to enter the following as your legal business name:

ACME LLC THERESA LOPEZ-FITZGERALD SOLE MBR

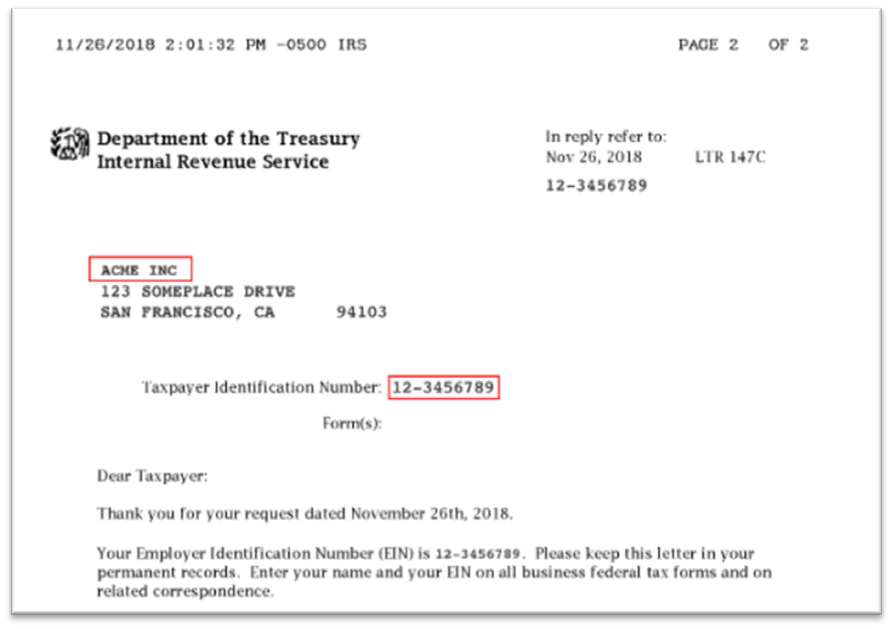

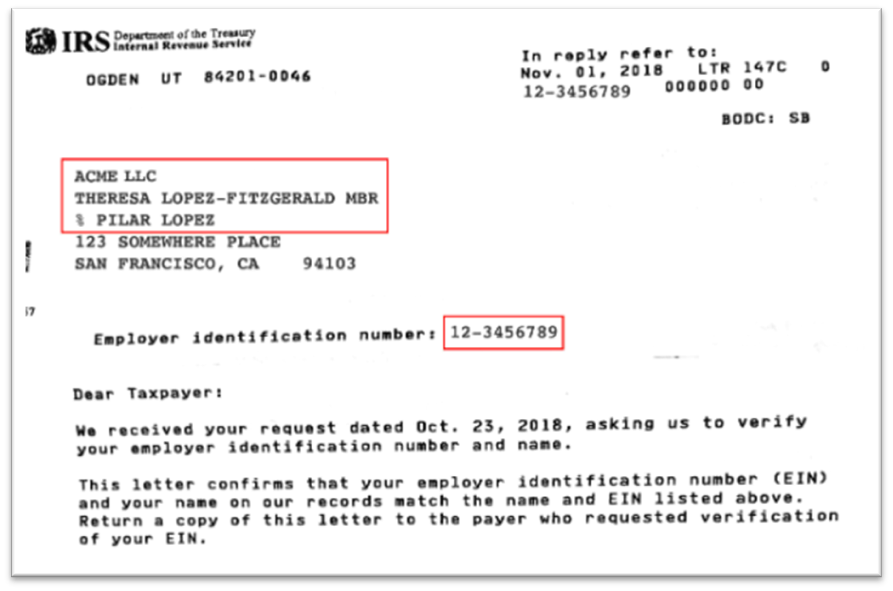

IRS LTR 174C

What is an IRS LTR 174C?

A LTR 147C is a letter from the IRS that verifies your Employer Identification Number (EIN), also known as a Taxpayer Identification Number (TIN).

Below are two examples on how you can enter your information based off of the IRS LTR 174C correspondence.

EXAMPLE 1

If your business name looks like this on your IRS LTR 147C, you might need to enter the following as your legal business name:

ACME INC

EXAMPLE 2

If your business name looks like the above on your IRS LTR 147C, you might need to enter the following as your legal business name:

ACME LLC THERESA LOPEZ-FITZGERALD SOLE MBR % PILAR LOPEZ

What if my TIN still cannot be validated after following these instructions?

- If the information provided does not match IRS records, then you will be prompted to retry.

- The system will limit how many times you can retry so it is important that you provide the correct information.

- If you have exceeded the allowable number of attempts, you will be prompted to attach a document or correspondence from the IRS showing your Taxpayer Identification Number (TIN).

If the TIN is not able to be validated then you will be asked for supporting documentation.

Please attach a document or correspondence from the IRS showing your Taxpayer Identification Number (TIN) and Legal Company Name, such as:

- SS-4 Confirmation Letter from IRS

- Letter 147C from IRS

- Schedule C from most current tax returns (you may redact income and other information but the Legal name and TIN must be clearly visible)

What happens after I submit documentation?

The system will allow you to move forward with the EDC application process but your application will be submitted for further review.

- If after internal review by SupplierGATEWAY your TIN is validated, no further action is required from you.

- If after internal review by SupplierGATEWAY your TIN cannot be validated, you will receive an email communication requiring your attention.

As a reminder, SupplierGATEWAY requires your Taxpayer Identification Number (TIN) and Company Legal Name in order to process your Enhanced Digital Certification (EDC) application. This information is required to match the information in the IRS database and it is a prerequisite of the EDC application process that the TIN is successfully validated.

Comments

0 comments

Please sign in to leave a comment.